In the digital age, small businesses increasingly rely on efficient network infrastructure to support business growth and information transfer. However, as many small business owners have experienced, networking faces its own set of challenges. Next, we will explore suitable optical networking solutions around these issues.

Small Business Networking Challenges

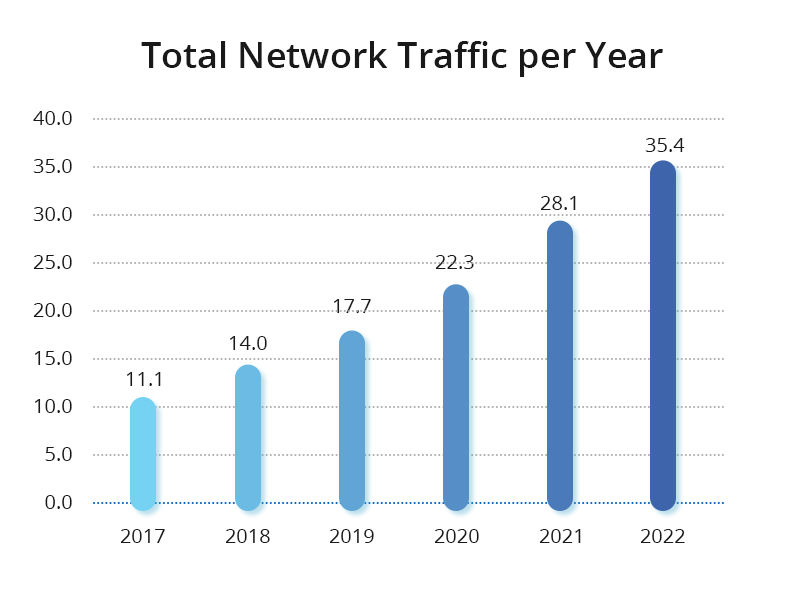

Bandwidth Bottlenecks

It’s a common challenge for small business networks, restricting the speed and efficiency of data transfer. Traditional networks typically provide businesses with only a limited bandwidth, resulting in network slowdowns during peak hours or when handling substantial data loads. This not only affects employee productivity but also has implications for hinders overall business growth.

Performance Limitations

Traditional networks face performance limitations when dealing with business growth and extensive data demands. As an enterprise expands, the rigidity of traditional network architecture becomes evident, rendering it incapable of effectively adapting to new business requirements. This, in turn, can result in network congestion, delays, and instability, thereby affecting the day-to-day operations of a business.

Low Maintenance Efficiency

With a shortage of dedicated IT personnel, small businesses may encounter delays or insufficient monitoring, troubleshooting, and routine maintenance of network equipment. Concurrently, the manual nature of these monitoring and maintenance processes proves time-consuming and error-prone, thereby diminishing the overall efficiency of maintenance tasks.

Waste of Cable Resources

During the process of network transformation, many small business owners opt to abandon traditional cable deployments in favor of adopting fiber optic solutions, thereby rendering the original cables unusable and resulting in cable wastage.

These challenges not only affect employees’ efficiency but also exert a detrimental influence on overall business growth. Addressing these challenges necessitates the implementation of advanced technologies and optical networking solutions, which becomes crucial.

Unraveling the Wonders of the 10G Multi-Rate Optical Module

In this context, the utilization of 10G multi-rate optical modules serves as an effective solution to challenges encountered in small business networks, including bandwidth bottlenecks, performance limitations, low maintenance efficiency, and cable wastage. This adaptive Ethernet module supports rates of 100M, 1G, 2.5G, 5G, and 10G, contributing to the establishment of a more robust and reliable network infrastructure for small enterprises.

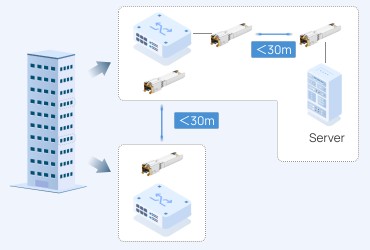

Therefore, FS has also introduced 10G multi-rate optical modules, assisting small business owners in better addressing these challenges. The transceiver delivers 10GBase-T throughput for distances of up to 30m over Cat6a/Cat7 copper cables using an RJ-45 connector. It complies with IEEE 802.3-2012, IEEE 802.3ab, and SFP MSA standards. Each SFP transceiver module undergoes individual testing, ensuring compatibility with various switches, routers, servers, network interface cards (NICs), and more. Known for its low power consumption, this easily installable, hot-swappable 10G SFP transceiver is well-suited for enterprise networking in LAN applications and other networking environments utilizing copper connections.

Optimize Your Business Connectivity: Selecting Better Optical Networking Solution

The introduction and implementation of 10G multi-rate optical modules in optical networking solutions can markedly enhance network performance. This application supports larger data transmission capacity and reduces the delay in data transmission. This not only improves network efficiency for enterprises, but also provides scalability for future business growth. The following is the application of this multi-rate module in actual scenarios of small businesses.

File Sharing and Data Storage

The 10G Multi-Rate Optical Module significantly enhances the efficiency of file sharing and data storage by providing a data transfer rate of up to 10Gbps. Employees can swiftly access and transmit large-capacity files, and multiple users can concurrently access the file server. With the growth of business operations, the 10G multi-rate optical module offers scalability to adapt to the escalating demand for data storage, providing an enduring solution for sustainable file sharing in enterprises.

Video Conferencing and Real-Time Collaboration

In video conferencing scenarios, the 10G multi-rate optical module ensures high-definition video transmission, delivering a clear and seamless meeting experience for remote teams. This is crucial for real-time collaboration and communication. The low-latency feature guarantees the timeliness required for video and audio transmission in conferences, enhancing the overall effectiveness and engagement. The reliability of the module ensures stable connections, preventing signal interruptions or quality degradation.

Cloud Service Access and Data Center Connectivity

The 10G multi-rate optical module facilitates swift access to cloud services for small enterprises, enabling rapid uploading and downloading of large volumes of data to the cloud. It supports the demands of cloud computing and storage, providing enterprises with a more efficient experience of cloud services. Moreover, it enhances the data security of cloud services, safeguarding sensitive information for enterprises.

Optical Networking Solutions Tailored for Small Businesses

In order to tackle challenges like low network operational efficiency, cable wastage, and limitations in bandwidth and performance, small businesses require a customized optical networking solution. As a prominent solutions provider in the industry, FS has specifically crafted a 1/10GBASE-T Solution for Campus & Enterprise Network, featuring three key value propositions.

Enhanced Cable Utilization

Optimize the use of existing copper cable resources during network construction, minimizing the deployment of optical cables. This not only ensures the network’s normal development but also significantly reduces investment costs.

High Flexibility and Scalability

The 10G multi-rate optical module supports speeds ranging from 100M to 10G and can operate at different rates based on bandwidth requirements. This provides a high degree of flexibility to accommodate varying needs.

Simplified Maintenance

In contrast to traditional optical modules, these modules lack complex DDM information, simplifying the troubleshooting process. The streamlined operations, coupled with the elimination of the need for optical instruments, enhance overall troubleshooting efficiency.

Conclusion

In summary, small businesses facing network challenges may consider adopting the technology of 10G multi-rate optical modules. By providing greater bandwidth and higher performance, this technology facilitates the establishment of a robust, flexible, and efficient network infrastructure, promoting sustainable business growth. In the digital era, such network upgrades are not only an investment but also a crucial step for small businesses to open up broader development opportunities.

Related resource: Optical Networking Solutions for SMB

-18.jpg)

-17.jpg)